Up-and-Coming Cities for Insurance Jobs

Here are just some of the up-and-coming cities for insurance jobs to keep your eye on.

The science of recruiting.

Here are just some of the up-and-coming cities for insurance jobs to keep your eye on.

In our annual survey of job seekers, the number one complaint is that after applying to jobs, they never hear a peep from the employer on their status except an automated email. This certainly is not breaking news.

Here’s a quick look at some of the different types of claims jobs for your insurance career.

You heard it hear it here first. In the next couple years, your resume will only be one half of a page.

They’re young, healthy, and busy planning their futures, but how many millennials are even thinking about insurance?

The insurance industry is full of great jobs. Jobs in claims, underwriting, loss control, customer service, actuarial, technology and many other areas are available.

I have always told job seekers that if you can find a hiring manager at a company you want to work for who is active on Twitter, you hit a homerun.

Whether you are new to GreatInuranceJobs.com or a longtime user of the website, it’s hard to believe we turned 15 years old on June 6, 2016.

It’s seems like just yesterday that we started GreatInsuranceJobs.com the year. To put it in perspective, we started the same year as Wikipedia and also the introduction of the iPod (remember that!).

Serving the insurance industry since June 6, 2001.

If you have an eye for detail, are extremely organized, and enjoy working with rules and numbers, consider a career as an insurance claims adjuster.

The insurance industry will be losing 25% of its workforce through 2018. The primary reason? A retiring workforce.

Here are few challenges insurance companies are facing today, and what this means for you when you are looking for a job

When we heard that Prince died last week, most people went right to the internet to get more information. If you Google “Prince Death” in news, you will find numerous articles about this subject.

Many job seekers leave interviews thinking they did a great job and just to find out they didn’t get the job. It may have happened to you.

Here’s what you need to know about pursuing a career as a risk manager or risk consultant.

The RIMS 2016 Conference will take place April 10 to April 13, 2016, at the San Diego Convention Center. If you’re an industry professional or looking for job opportunities in this field, be sure to secure your ticket for this highly anticipated event.

For the last 8 years, we have been calling insurance companies and asking them to give us some insight on the jobs they have open, their future hiring plans and what challenges they have through the hiring process. In 2015, the insurance industry saw a record number of employees (over 2.5 million) and continues to have one of the lowest unemployment rate in any sector (2.3%).

The insurance industry is set for another a huge hiring year, according to a report out today from GreatInsuranceJobs.com. With 91% of companies with current open jobs and a nearly across-the-board (98%) plan to hire at least one person in 2016, the employment market in insurance remains very strong. Going beyond the Bureau of Labor and Statistics numbers, this report offers real insight into the state of the insurance industry.

We just released the 2016 Insurance Industry Survey. We talked directly to over 70 companies and uncovered some fantastic information that will help insurance employers get a real picture of what is going on in their quest to find great insurance talent.

Whether you’re just breaking in to the insurance industry or are looking to move forward in your career, you need to seek out employment from an established and reputable insurance firm. More than 466,000 insurance jobs were reported in 2014 alone, according to the U.S. Bureau of Labor. Job growth is expected to increase at a rate of 9% through 2024 which means you can find a variety of opportunities at companies and brokerage firms across the country.

If you’re tired of your current job and are on the lookout for more opportunities, consider a job in insurance sales. The insurance industry is evolving and growing at a rapid pace so there is an ongoing demand for highly trained sales representatives, managers, and independent business professionals. Even if you don’t have a strong sales background, you’ll find it relatively easy to learn basic skills and knowledge to pave your way to success in this industry.

If you've been exploring careers in the insurance industry, you may have considered work as an insurance broker or insurance agent. The Insurance Information Institute reports 2,467,000 people were employed in the insurance industry in 2014 and the U.S. Bureau of Labor Statistics predicts a high job growth rate of 9% for insurance sales agents through 2024. Working as an insurance broker or agent can be personally and financially rewarding.

Insurance agents and brokers enjoy rewarding careers with almost unlimited earning potential. If you want to be the best in the business, you need to acquire certain skills and characteristics during your career. Whether you’re just getting started or have been working in the insurance industry for a few years, there are several ways to take your career to the next level.

It’s amazing all the tools that are being created to find great talent. The one thing that has not changed is how hard it is to fill that “hard to fill” position. Insurance positions like actuaries, production underwriters, and insurance brokers with books of business, account managers and loss control professionals.

Ever watch a speaker go way to long talking about a certain topic? You know, the kind that has you looking at your watch wishing you were at the dentist. According to TED.com, it is proven scientifically that the ultimate length of time for the most memorable and impactful speeches is just 18 minutes. Bad speakers spend the first 10 minutes telling you about themselves instead of using that time to grab your attention on their topic.

Whether you’re ready for a career change or looking to move up in your career, don’t overlook the many perks of working in the insurance industry. In addition to an influx of job opportunities over the next decade, insurance industry professionals enjoy a number of benefits that are hard to find in other career paths.

Working as an insurance agent or broker is usually the first thing that comes to mind when people think of insurance jobs but there are several non-sales roles that can help you break into the insurance industry. When you’re searching for entry-level jobs in the insurance field, you can get your career off the ground with a job in marketing, underwriting, or even find work as a claims investigator.

Congratulations, you did it! After what seemingly felt like an eternity, you find yourself walking across that glorious stage on graduation day, and in that very moment, you are on top of the world. No more waking up at the crack of dawn to get to class, final exams are done and over with, and you no longer have to worry about being taken out by a hoverboard while trying to get from point A to point B on campus. Life is fantastic.

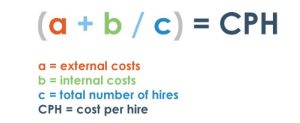

According to from Bersin by Deloitte, US companies are spending an average of $4,000 in cost per hire in 2015. That is expensive especially when your hire doesn’t work out. It may be time to consider doing some blind interviewing.

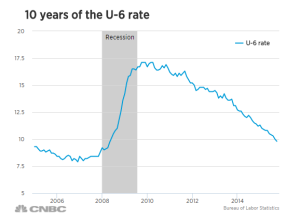

Now that the job market is flooded with more part-time work than ever before, finding a full-time job has never been more difficult. And according to the most recent Bureau of Labor Statistics employment report, nearly two in 10 U.S. workers are part-time—significantly higher than pre-recession levels. So unless your full-time job search strategy involves building a time machine to the pre-recession era, your best option is to focus on the next full-time opportunity available in your company.

The number one complaint by jobseekers is the lack of communication when you apply to a job (that you qualify for) and never hear back from the employer. This could be due to many factors like a poor resume, numerous jobs or a poor internal screening process. No matter what the reason, most job seekers just want a chance to prove they are a good fit with a company and can do the job; many of you just never get the chance.

As a recent college grad, I cannot even fathom the idea of looking for jobs in the classifieds. With the invention of the internet and the job search engine, finding opportunities through these services are more streamlined and catered to each users’ individual needs. Sites, such as OrlandoJobs.com, provide an extensive database of job listings that can be accessed quickly and at any time.

In 2015 I spoke with over 5,000 job seekers at career events at colleges, career expos and in my own offices. One thing for sure, they have a lot of ideas on how their job search experience can be improved. I asked many of them to tell me what frustrates them the most when looking for a job and these are the top four things that kept coming up.

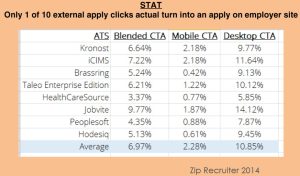

When you apply to a job with a larger company today, you will inadvertently have to use their applicant tracking system (ATS) to create your own “web page” on their internal servers. The company will use their own search terms to find you and if your information matches, you may get called for an interview. (I have written many articles on ATS’s.) By far, the number one complaint I hear from job seekers is that then NEVER hear back from the employer after they apply.

If all companies and recruiters had one wish it would be to make all job seekers and job curious use only one exclusive job board when seeking employment. It used to be that way in the Sunday Newspaper classifieds before the internet. If your jobs were not in the Sunday paper, you would not get any candidates except for internal referrals. On top of that, if you had an opening on Monday, you would not be able to advertise that opening until Sunday. Not very effective.

2016 is looming right around the corner. Is it time for a new job? The Bureau of Labor Statistics (BLS.gov) official unemployment rate is the also known as the U-3. Nationally, that rate is 5.0% (October 2015). This is pretty good. The US has added a lot of jobs in 2015 and seems like that is not slowing done anytime soon.

The recession was pretty brutal to the live job fair industry. Employers had no reason to attend simply because they had too many resumes coming in for the few jobs they had open. Many of the job fairs during this time featured few jobs (many jobs being 100% commission) and lots of education resources.

My checklist for first impressions is very simple and it should be. When interviewing, so many spend time trying to memorize canned answers to questions like, “tell me about your greatest weakness?” Sure you need to be prepared but make sure that you do a great job with your first impression. It will make the rest of the interview go much smoother.

According to Bersin & Associates, U.S. companies are spending and average of $3,500 per employee to just recruit them. While finding great talent is difficult, after over twenty years in the recruiting business, I think one of the main reasons this cost is so high is because employers are taking forever to make an offer to a candidate. Think about it. You spend so much time and money trying to find the right candidate and when you do, the process of hiring that person just seems to drag on.

We have all heard the saying "always the bride's maid, but never the bride. It is a sad, old cliché, yet for some candidates interviewing for a job, it may seem like the norm for them in the interviewing process as they always make it to the final interview, but are passed over for another candidate who has that "something extra."

Bring back the recession! For recruiters and human resource departments, the recession made any resource you used to find talent the “best thing ever”. Sure, you didn’t have many openings and millions of great people were unemployed and looking for work. In addition, your internal referrals were at an all-time high. You were able to save money by cutting out many of your recruiting tools.

For most of you, I wish all interviewers started off with this question. Answered properly, it allows you to set the tone for the rest of the interview. Unfortunately for many, it also is why so many of you screw up the interview.

The unemployment rate in the insurance industry hovers around 2%. When an insurance company needs to hire, they usually have a “go to” procedure that takes the job requisition and posts it to their company website as well as employment sites like GreatInsuranceJobs.com. Copy and paste is still the preferred way to post these jobs that have job titles and descriptions most likely created years ago.

Last month’s article was “Should I Write My own Resume?” This month, I am going to answer that question. No. Never. No matter what. Even if you only have year or fifty years of experience.

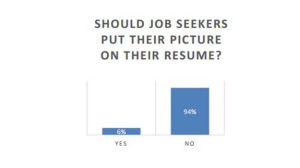

Our 2015 Insurance Industry Employment and Hiring Outlook asked 78 insurance companies if they think job applicants should put their photos on their resume (page 8). Not surprisingly, only 6% thought this was a good idea. When asked if why they feel that way is the concern with discrimination, one insurance human resource manager answered, “Absolutely not, because there are characteristics in a photo that could potentially lead to a discriminatory decision before the interview.”

Writing your own resume is an accident waiting to happen. Your resume is the golden ticket to getting a great job with a maximum salary.

With over 2.5 million people (all-time record) now working in the insurance industry, finding great talent is extremely difficult in 2015. In our 2015 Insurance Industry Employment Outlook, employers recruiting insurance talent openly shared very candid recruiting challenges they are experiencing.

Many of you will apply to jobs at an insurance company and wonder why you didn’t get hired. Complicating matters even more is you may never get any feedback from the employer (the infamous “black hole”. Hopefully this list that comes directly from insurance employers will help you understand some of the reasons that you didn’t get hired.

In totality, the GreatInsuranceJobs.com Employment Outlook for 2015 found 7,262 jobs currently open at the 78 companies within their survey. Another 15,354 jobs were predicted by the hiring managers for those companies during the remaining three quarters of 2015.